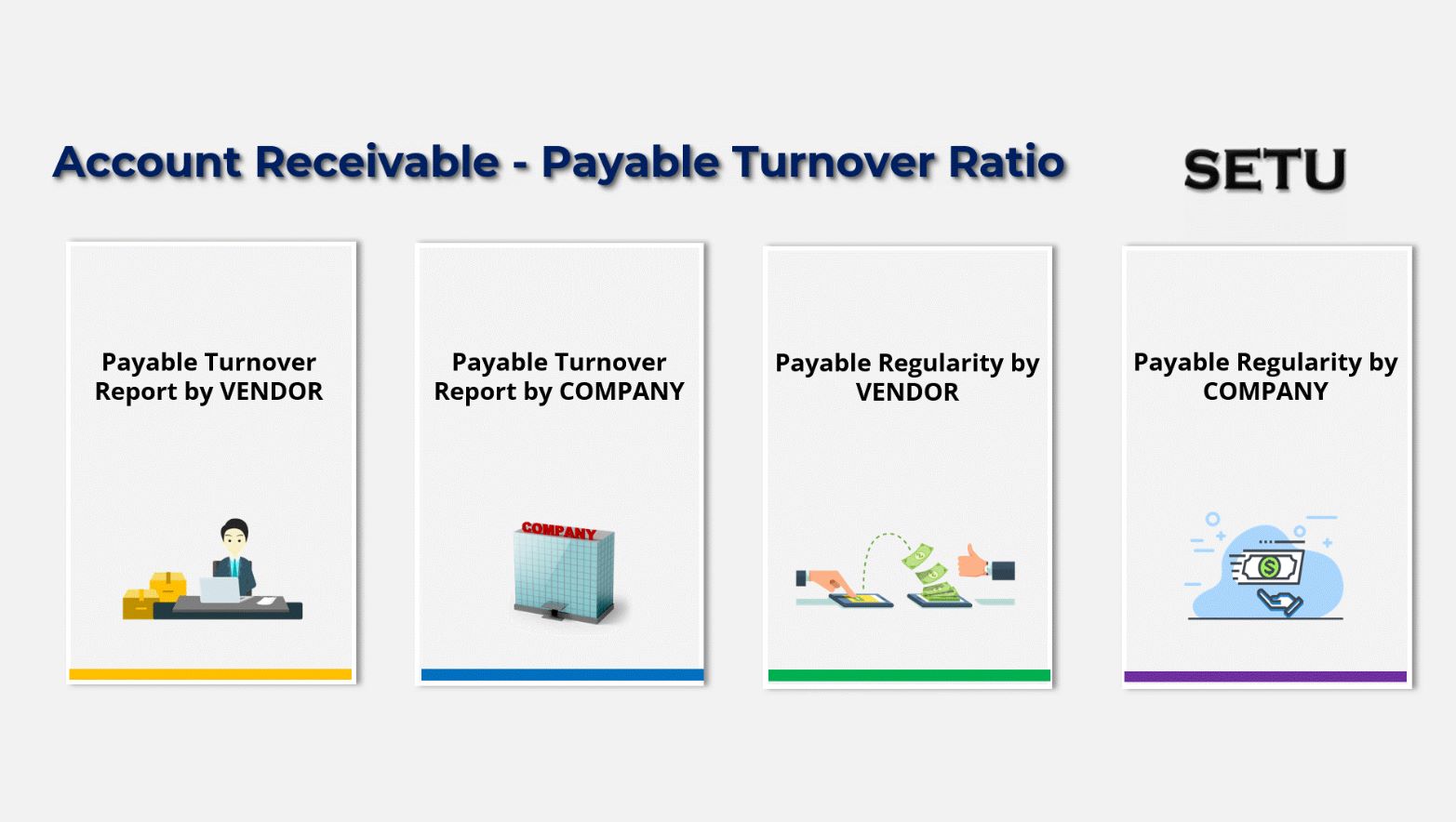

Account Receivable / Payable Turnover Ratio

9,99 $

In order to check the financial stability, obtain credits, and invest in the growth of a Business, tracking and analyzing payment regularities both from customers and to vendors becomes mandatory.

SKU: N/A

Category: Accounting

Account Receivable / Payable Turnover Ratio

In order to check the financial stability, obtain credits, and invest in the growth of a Business, tracking and analyzing payment regularities both from customers and to vendors becomes mandatory.

Hence as an owner, your priority focus switches to analyzing payments that your customers make.

But when Business expands, you may find it difficult to track,

- How many days does the Company take to collect the outstanding debt throughout the accounting period?

- When will the Customer pay the remaining bill amount?

- Within how many days do you pay to which Vendor?

- Which company pays within how many days?

- Is your Business at present in Credit or in Debt based on Receivables and Payable?

The Receivable and Payable ratio generates analytical and statistical reports based on customers, vendors, and companies that enable top management to assess the financial health of the Company by letting you know

- What are the Receivable Days within which you will receive payment from each Customer?

- What are the Payable Days within which you will pay each Vendor?

- Within how many days does the Company receives all the pending bill amount from customers?

- Which company is how much Regular in receiving its payment?

- Within how many days the Company pays the pending bill amount to vendors?

- Which Company is how much regular in paying its remaining amount to Vendors?

- Within how many days Company converts back its investments to cash again through sales?

So that your Business possesses,

- Smooth CashFlow

- Able to Forecast Budget

- Capable of implementing business growth strategies efficiently

- Identify ineffective billing Customers

- Segment Customers based on their Payment regularities

- Being capable of deciding Credit limits for Customers

| Select Version | V15, V17 |

|---|

Related products

Accounting

19,00 $ – 20,00 $

Accounting

49,00 $

Accounting

2,00 $

49,00 $

Accounting

29,00 $ – 49,00 $

19,00 $ – 20,00 $

10,00 $ – 15,00 $